2-4 Family Home For Sale in Wallington, NJ

MLS# : 26002587

PROPERTY DETAILS

PROPERTY DESCRIPTION

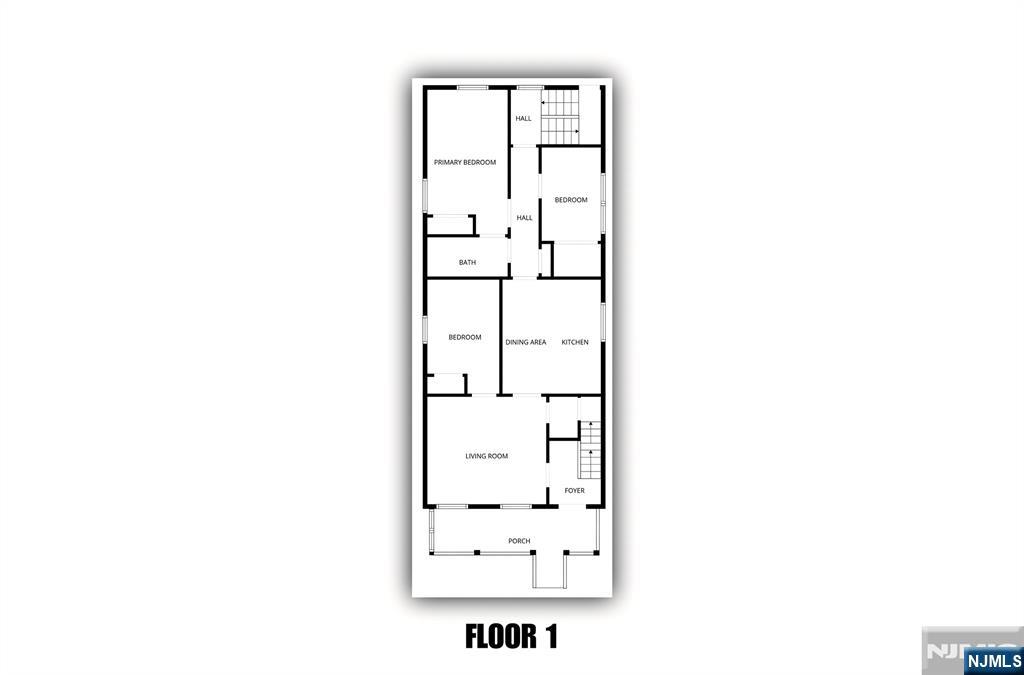

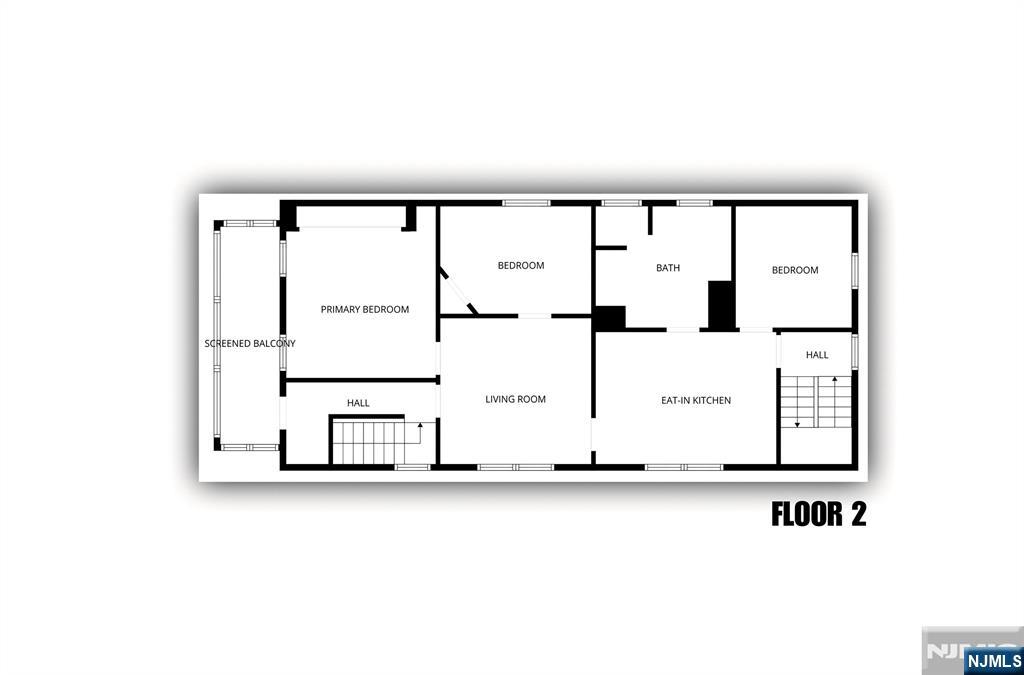

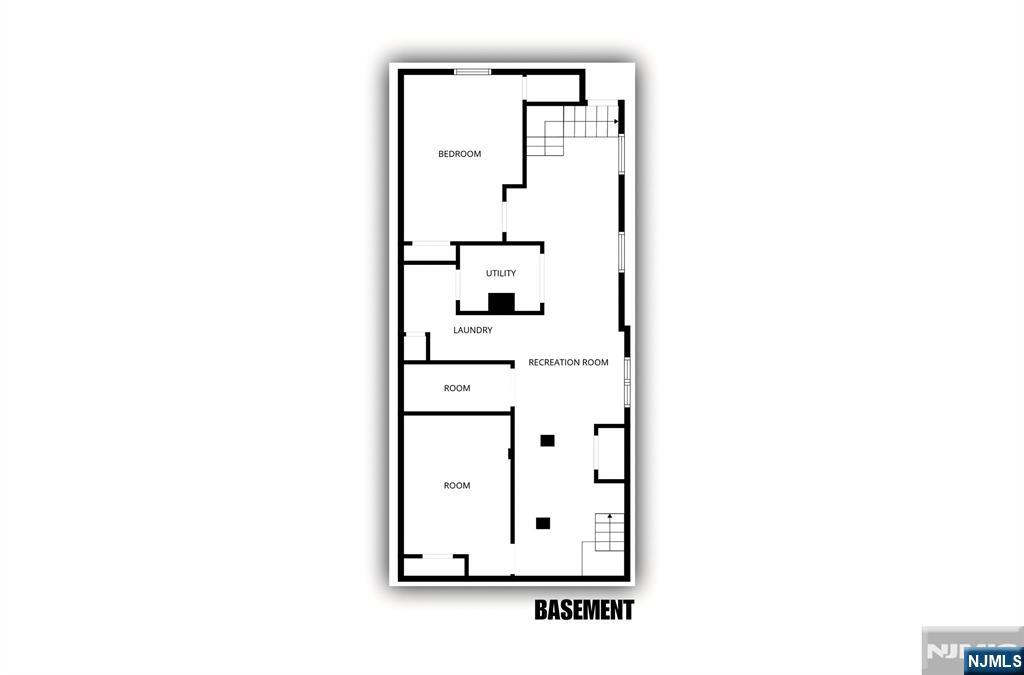

Welcome To This Well-Maintained Two-Family Home Located On A Quiet Residential Street In Wallington, Bergen County. Each Unit Offers Three Bedrooms And One Full Bath. The First Floor Will Be Delivered Completely Vacant At Closing, Offering Immediate Flexibility For Owner-Occupants Or Investors. Features Include Separate Utilities, Central Air And Forced Hot Air, Stainless Steel Appliances, And Laundry Hookups On Each Floor. The Home Also Features A Fully Finished Basement, Providing Additional Living Or Recreation Space. Situated On A Desirable Block Close To Shopping, Dining, Public Transportation, Schools, And Major Highways, This Property Offers Both Convenience And Long-Term Value. A Fantastic Opportunity In One Of Bergen County’s Strong Rental Markets. A Must See Property..

Amenities

This listing is a courtesy of Keller Williams Realty - NJ Metro Group

973-783-7400 office, listing agent Mayrening Reyes

About Wallington, NJ Real Estate Market

The establishment of Wallington as a borough happened in 1895, after some portions of Saddle River Township and Bergen Township based on the results of a referendum. Wallington is one of those 26 boroughs established as permanent boroughs during the Boroughitis phenomenon in 1894.

Apart from several small-sized New Jersey homes, Wallington is home to a couple of places of interest. The Samuel Nelkin County Park is a 17-acre open recreational space with picnic areas, an artificial pond for fishing and sports arenas. There is also a Bowlero Wallington bowling alley with a restaurant and bar. The naming of the Borough of Wallington is inspired by Walling Van Winkle, who was one of the first people who built a home after Wallington got established as a borough.

| Population: | 11,335 |

| Total Housing Units: | 4,946 |

| Single Family Homes: | 2,155 |

| General Tax Rate (2023): | 3.271% |

| Effective Tax Rate (2023): | 2.104% |

| Compare To Other Towns |

Wallington Market Indicators

Search

MLS#

MLS#

MLS#

MLS#

MLS#

MADISON ADAMSTM

Ridgewood, NJ 07450

201-760-1100 (office)

201-760-1102 (fax)