Land For Sale in Wyckoff, NJ

MLS# : 25040651

PROPERTY DETAILS

PROPERTY DESCRIPTION

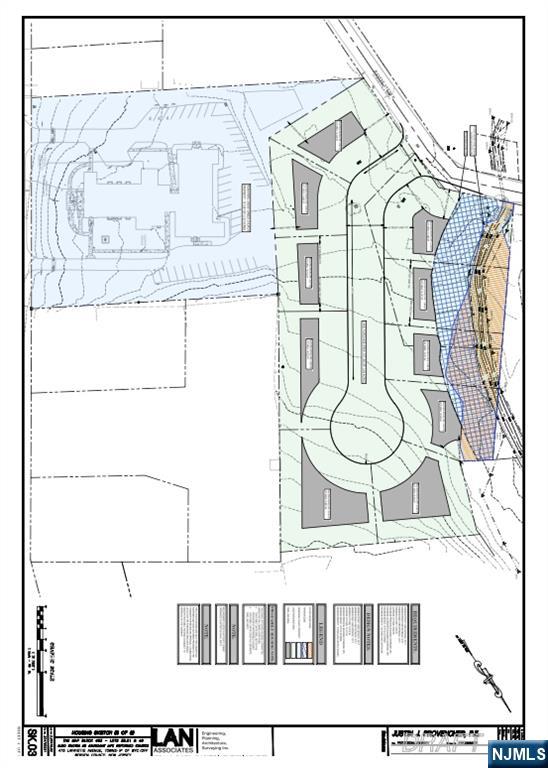

Rare opportunity to build 10-12 new homes in new subdivision in bucolic Wyckoff, NJ. (See attached sketches). Final development proposal must meet Mt. Laurel affordable housing requirement. Town ordinance has already been approved deliniating the zoning requirements. (See attached). Gently sloping lot. Purchaser to submit plan for final approval to town, construct road and install utilities. Improved building costs must have a minimum lot size of 7,000 square feet and a maximum building height of 2.5 stories (35 feet). This listing incorporates Block 483 Lots 38.01 and 46. Development will require road construction and running utilities up the new road. Part of the property is wooded, part is paved. One existing home on property could potentially be renovated. Small part of lot has a seasonal stream. Building envelopes not in flood plain.

Current Zoning & Permited Use

This listing is a courtesy of RE/MAX SELECT - Franklin Lakes

201-891-0300 office, listing agent Mark Perry

About Wyckoff, NJ Real Estate Market

Wyckoff is one of the few boroughs in Bergen County with a per capita income of more than $50,000, which makes it a high-household income place in the United States. It means that the houses for sale in this part of NJ by owner are well-equipped with all the modern amenities, with the residents enjoying a high-quality lifestyle.

Before the mid-18th century, Wyckoff used to be a community existing within Franklin Township. From the 1840s, several new municipalities got created from the portions of Franklin Township, and Wyckoff was one of them. The establishment of Wyckoff as a borough happened in 1926 by an act of the New Jersey Legislature, which eventually replaced the Franklin Township based on the results of a referendum.

The naming of Wyckoff is derived from the Lenape word ‘wickoff’, which means ‘a high ground’. However, many people believe that the borough’s name was kept after the Wyckoff family settled in New York when it was a part of the Dutch colony. Apart from well-sized homes, one can also find several churches across the lanes of Wyckoff.

| Population: | 16,696 |

| Total Housing Units: | 5,827 |

| Single Family Homes: | 5,536 |

| General Tax Rate (2023): | 1.892% |

| Effective Tax Rate (2023): | 1.707% |

| Compare To Other Towns |

Wyckoff Market Indicators

PRICE INDEX

| Average Price* (12mo): | $1,244,651 |

| Homes Sold* (12mo): | 137 |

Search

MLS#

MLS#

MLS#

MLS#

MLS#

MADISON ADAMSTM

Ridgewood, NJ 07450

201-760-1100 (office)

201-760-1102 (fax)