Land For Sale in Paramus, NJ

MLS# : 25026756

PROPERTY DETAILS

PROPERTY DESCRIPTION

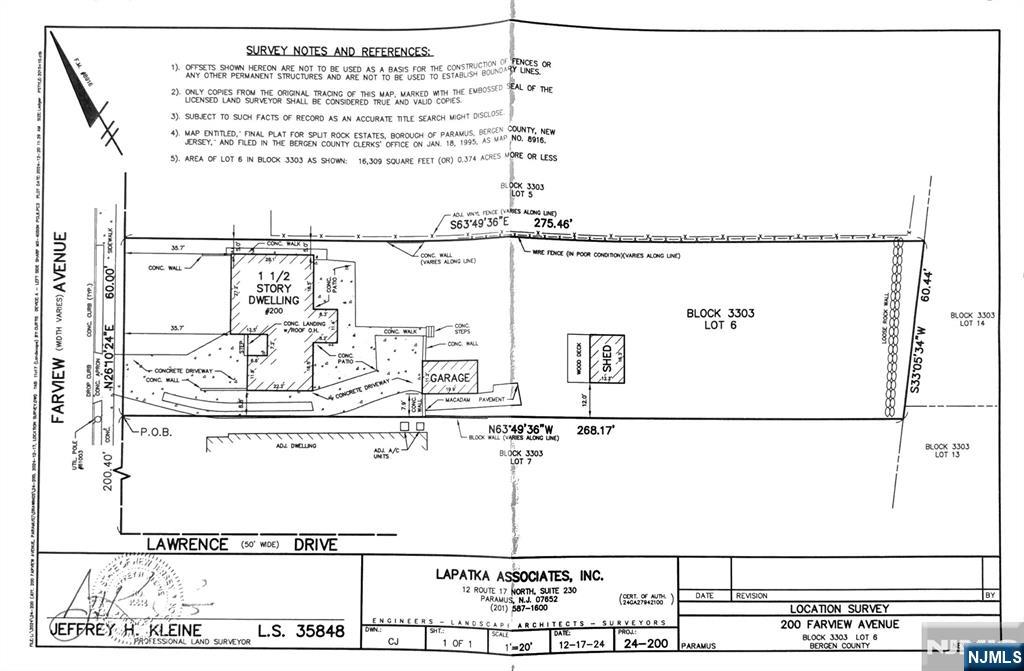

Build your dream home on a convenient Paramus location. Close to all and in the heart of the town. Attention builders: This .38 acre lot is approximately 60 x 283 x 60.10 x275. Please see attached recent survey. No easements noted on survey. It gradually slopes downward. Ready for your to build a custom home on. The prior home on the lot, it's basement and driveway have all been removed. Driveway concrete apron is still present. Mature trees offer natural privacy buffer on the back lot perimeter and some of the back sides of this beautiful lot. Convenient & close location to multiple houses of worship & schools, you will have a front view seat for the annual Paramus 4th of July parade!

Current Zoning & Permited Use

- Other

This listing is a courtesy of RE/MAX Properties-Saddle River

201-825-6600 office, listing agent Jeana Cowie

About Paramus, NJ Real Estate Market

Paramus is one of the largest shopping destinations in America with many high-end stores and shopping centers enjoyed by shoppers from around the area and New York City.

Paramus residents have access to many parks in town and natural habitats with the only zoo in Bergen County in Van Saun County Park and a six mile bike path stretching from Ridgewood to Rochelle Park.

The town of Paramus has relatively low property taxes and highly ranked public and private schools.

| Population: | 26,342 |

| Total Housing Units: | 8,915 |

| Single Family Homes: | 8,124 |

| General Tax Rate (2023): | 1.533% |

| Effective Tax Rate (2023): | 1.430% |

| Compare To Other Towns |

Paramus Market Indicators

PRICE INDEX

| Average Price* (12mo): | $1,103,375 |

| Homes Sold* (12mo): | 211 |

Search

MLS#

MLS#

MLS#

MLS#

MLS#

MADISON ADAMSTM

Ridgewood, NJ 07450

201-760-1100 (office)

201-760-1102 (fax)