Single Family Home For Sale in Maywood, NJ

MLS# : 25019324

PROPERTY DETAILS

PROPERTY DESCRIPTION

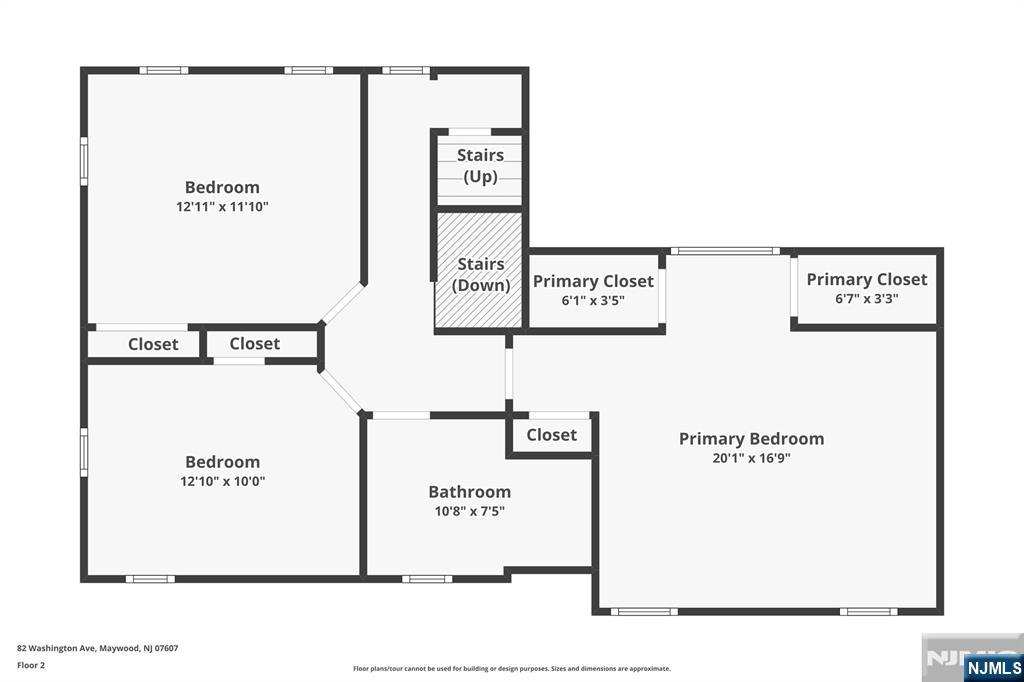

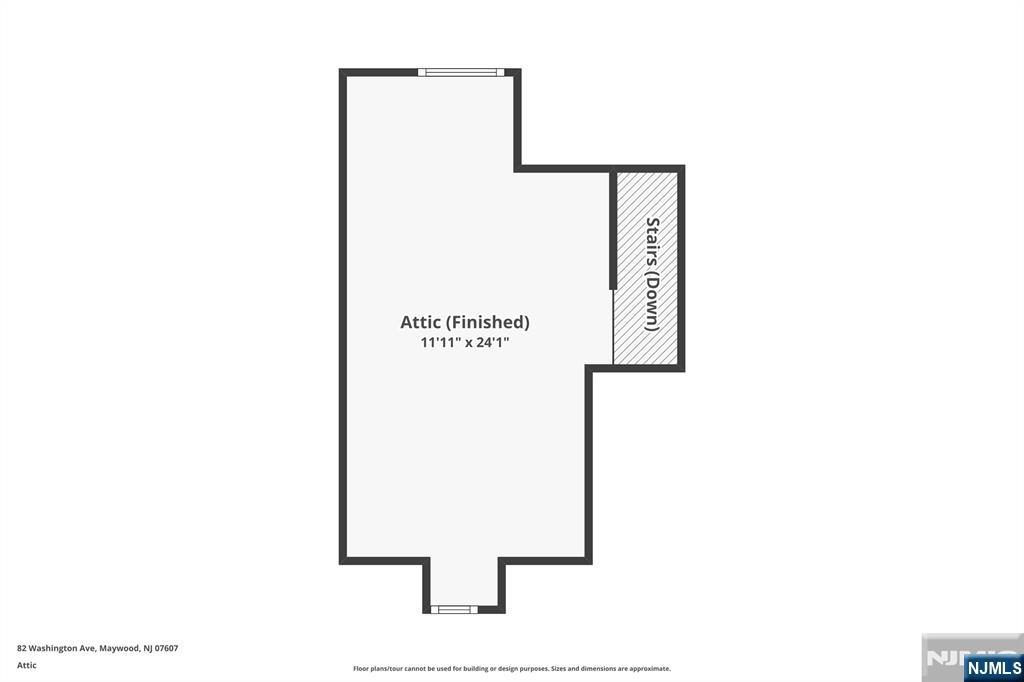

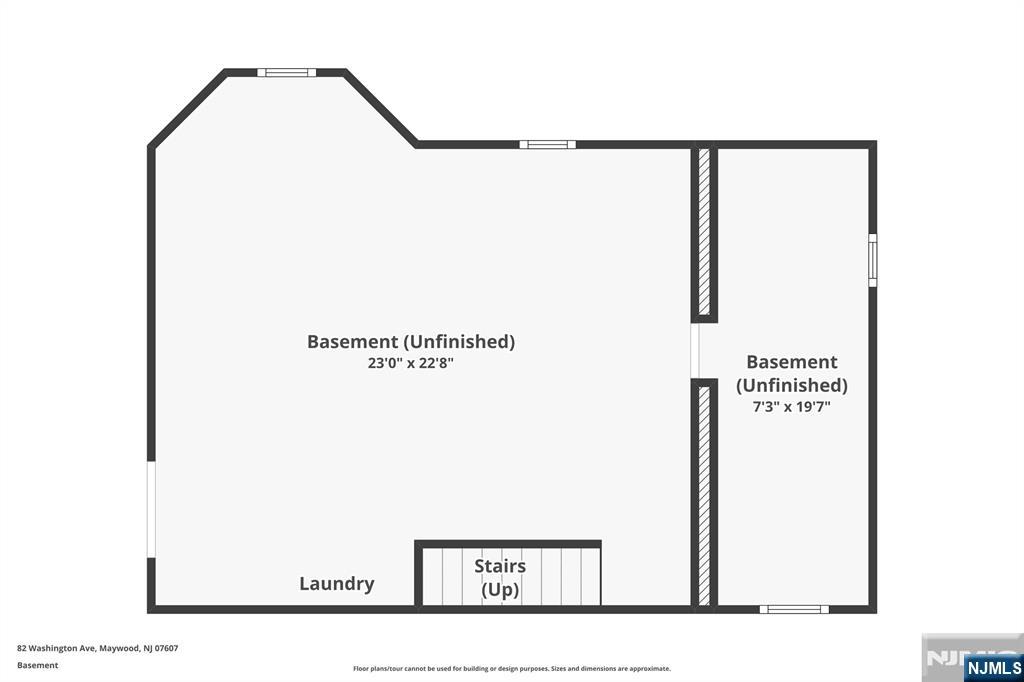

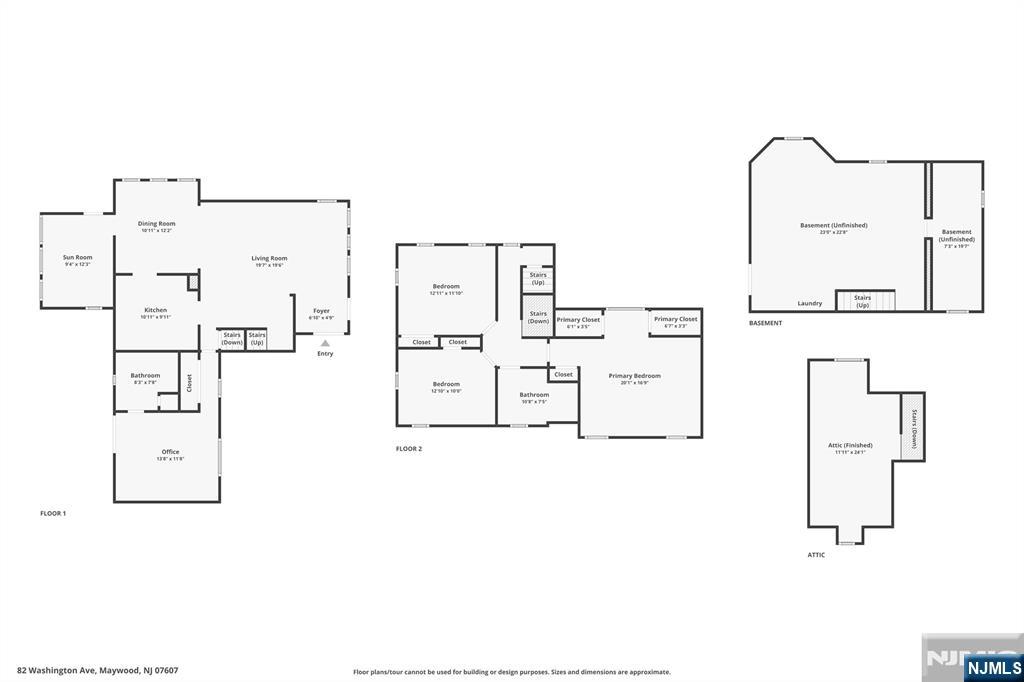

Beautifully expanded and updated colonial home in the heart of Maywood. First floor highlights EF, Formal Living Rm, Formal Dining Rm, All-season Breakfast Rm, KIT, Lg. Family Rm, and Full Bth. Second floor features two nice size BR, Full Bth, and Lg Primary BR w/2 deep walk-in closets. Attic is spacious and offering many possibilities for a bonus room. Basement is unfinished, but offers great space for additional storage. SGD from Family RM leads to lovely deck w/retractable awning, above ground pool, functional tool shed, and leveled yard. Pride of ownership throughout. Location is convenient shopping, restaurants, NYC transportation, and so much more. Truly a special home that will make all who enter feel WELCOME. Won't last! Truly a must see!

Amenities

Close/Parks, Close/School, Close/Trans, Close/Wrshp

This listing is a courtesy of Keller Williams Town Life

201-894-8004 office, listing agent Young Tak

About Maywood, NJ Real Estate Market

The borough of Maywood is spread over 1.29 square miles and got the title of a borough after taking in the portions of Midland Township based on the results of a referendum held in 1894. The borough of Maywood is one of those 26 boroughs, which were formed during the Boroughitis phenomenon in 1894.

Maywood is a small town that has small-sized homes owned by distant working professionals and retired people in abundance, who prefer small homes for sale in New Jersey. The borough has few parks and recreational places, one of which is Maywood’s Memorial Park across the street from Memorial School on Grant Avenue. This park is home to multiple baseball fields, football grounds, a basketball court, a fenced area for the dog park, bike paths and jungle gyms. It also has several churches, such as First Presbyterian Church, Our Lady Queen of Peace Roman Catholic Church, Zion Lutheran Church, Lutheran Church of the Redeemer and St. Martin’s Episcopal Church.

| Population: | 9,555 |

| Total Housing Units: | 3,769 |

| Single Family Homes: | 2,727 |

| General Tax Rate (2023): | 2.153% |

| Effective Tax Rate (2023): | 2.054% |

| Compare To Other Towns |

Maywood Market Indicators

Search

MLS#

MLS#

MLS#

MLS#

MLS#

MADISON ADAMSTM

Ridgewood, NJ 07450

201-760-1100 (office)

201-760-1102 (fax)