Commercial space For Sale in Hoboken, NJ

MLS# : 250012436

PROPERTY DETAILS

PROPERTY DESCRIPTION

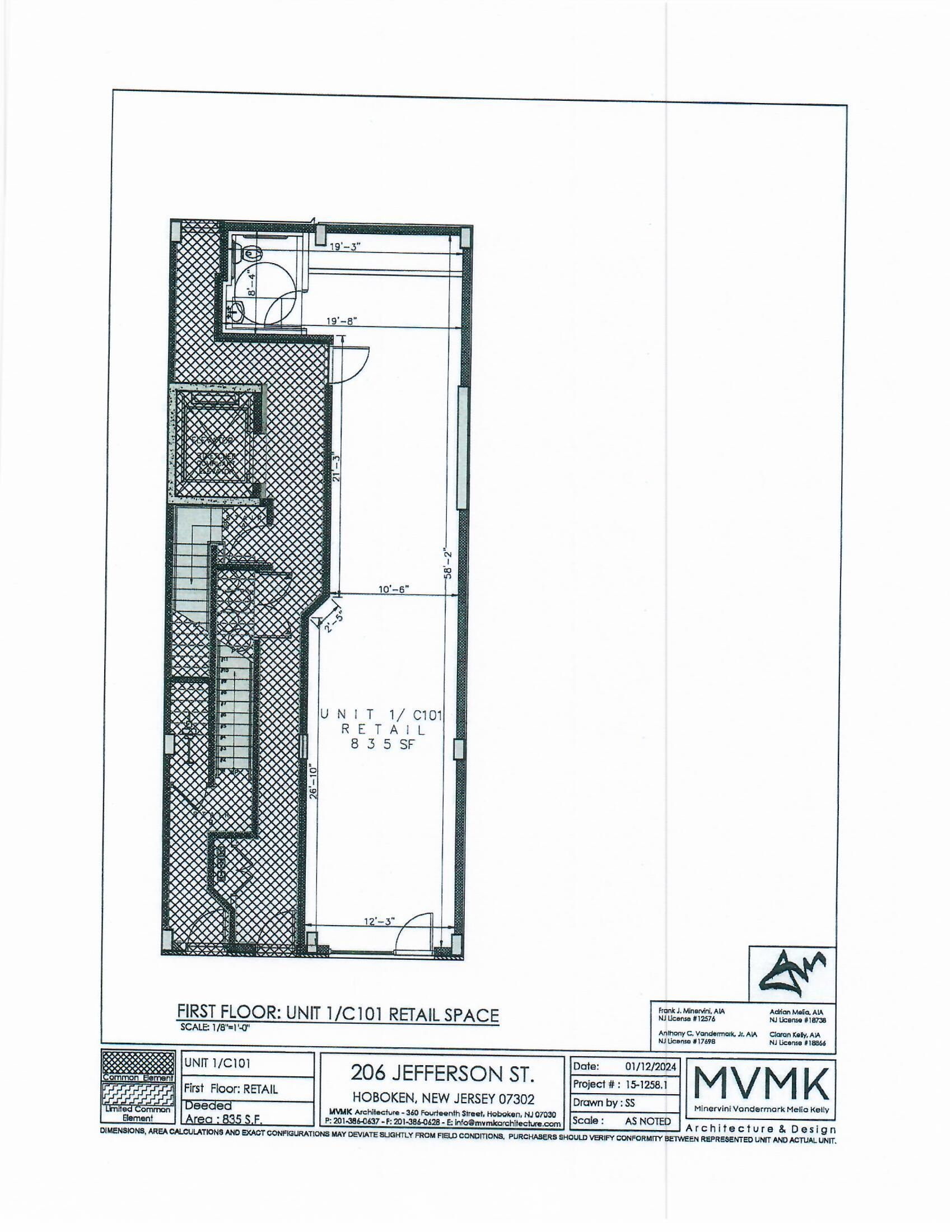

This property with a total frontage of 43' consists of 2 buildings with 4 stories which have been joined together. One building is 23' wide and the other is 20'. The depth of the lots are 100' and 105' respectively. The bottom two floors are currently used as commercial and on the top two floors each feature a 4 bedroom unit. The entire structure occupies most of the lot on the first two floors. The entire property will be delivered vacant at closing. There is no oil tank on the premises. Up to 4 deeded parking spots may be available on the block for an additional $75,000 each.

Amenities

This listing is a courtesy of SINGLETON GALMANN RE

201-656-5400 office, listing agent ANNE PELLETIER

About Hoboken, NJ Real Estate Market

Originally settled as a part of the Pavonia colony in New Netherland in the 17th century, Hoboken is now a fully developed city, the foundation stone of which was laid by Colonel John Stevens in the early 19th century. At that time, Hoboken existed in parts of Bergen Township and North Bergen Township and emerged as an independent city in 1855.

During most of the duration of the 20th century, Hoboken remained an integral part of the Port of New York and New Jersey and was a base for several industries. In the current day and age, Hoboken has become a fully-developed residential area with the best examples of Hudson County real estate with large-sized single-family houses and residential skyscrapers and condominiums.

| Population: | 54,142 |

| Total Housing Units: | 27,809 |

| Single Family Homes: | 2,355 |

| Apartments: | 25,454 |

| General Tax Rate (2023): | 1.628% |

| Effective Tax Rate (2023): | 1.032% |

| Compare To Other Towns |

Hoboken Market Indicators

PRICE INDEX

| Average Price* (12mo): | $2,373,956 |

| Homes Sold* (12mo): | 20 |

PRICE INDEX

| Average Price* (12mo): | $899,480 |

| Apatments Sold* (12mo): | 512 |

Search

MLS#

MLS#

MLS#

MLS#

MLS#

MADISON ADAMSTM

Ridgewood, NJ 07450

201-760-1100 (office)

201-760-1102 (fax)