Commercial space For Lease in Hackensack, NJ

MLS# : 25025288

PROPERTY DETAILS

PROPERTY DESCRIPTION

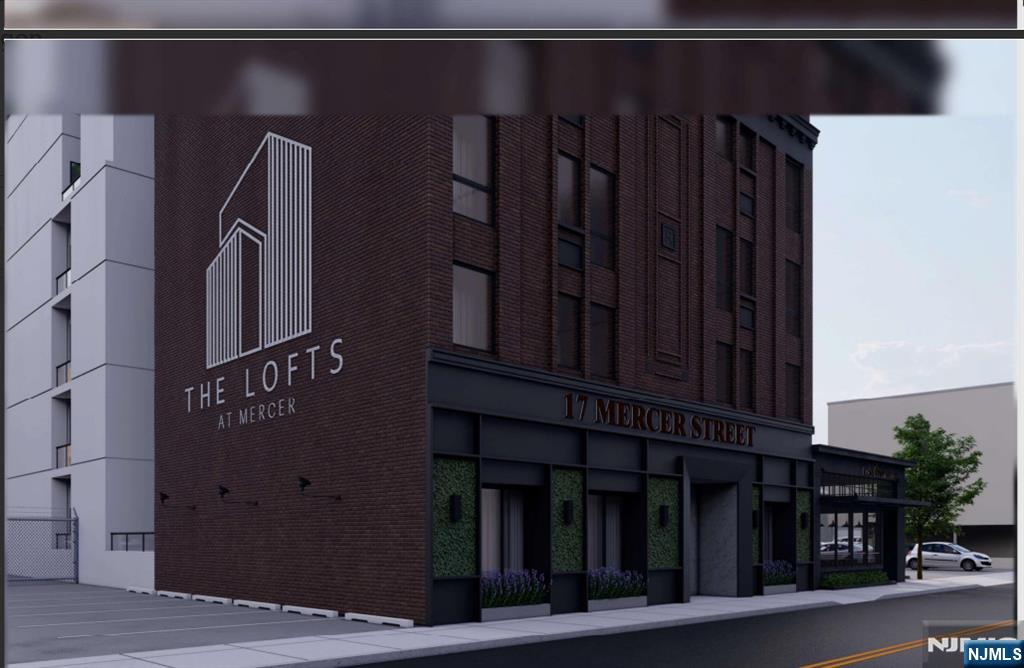

Prime Development Opportunity in Hackensack!! This approved, shovel-ready project offers a rare chance to invest in a fully entitled 6-story building totaling 35,060 sq ft. Approvals are ready to be handed over along with construction documents, Benefit from a 5-year hold strategy with a projected 18%+ IRR and a 1.90x targeted equity multiple. The site also qualifies for a tax abatement and offers cost segregation benefits. A local, experienced property management team is in place to ensure smooth operations upon completion. Located in a rapidly growing market with strong demand for new development, this is a turn-key opportunity for investors seeking scale, efficiency, and high yield in one of Bergen County’s most active urban centers.

Amenities

This listing is a courtesy of Berkshire Hathaway Home Services Abbott Realtors

201-891-2223 office, listing agent Vincent Stanson

About Hackensack, NJ Real Estate Market

Before 1921, the city was known as New Barbadoes Township. However, even then, it was informally known as Hackensack by the locals since the 18th century. The legal renaming of the city occurred in 1921 based on the results of a referendum. The name Hackensack is derived from its original inhabitants, the Lenni Lenape.

Being one of the biggest cities in Bergen County, Hackensack has several prominent landmarks. A few of those landmarks are the metropolitan campus of Fairleigh Dickinson University, New Jersey Naval Museum, World War II submarine USS Ling, Bergen County Court House and Hackensack University Medical Center.

The real estate of Hackensack is very diverse, and one can find many residential homes and complexes along Prospect Avenue between Beech Street and Passaic Street. Here, you will find various houses, like single-family houses, large garden apartment complexes and stately older homes. You can find a number of houses for sale in New Jersey in this city.

| Population: | 43,010 |

| Total Housing Units: | 19,375 |

| Single Family Homes: | 8,227 |

| General Tax Rate (2023): | 2.878% |

| Effective Tax Rate (2023): | 2.592% |

| Compare To Other Towns |

Hackensack Market Indicators

Search

MLS#

MLS#

MLS#

MLS#

MLS#

MADISON ADAMSTM

Ridgewood, NJ 07450

201-760-1100 (office)

201-760-1102 (fax)